In regards to navigating the elaborate globe of insurance, getting the appropriate Coverage Methods can sense like looking to solve a puzzle. But don't worry, you're not by itself In this particular! Insurance coverage answers are intended to protect you, your loved ones, and your assets from unforeseen challenges and money burdens. Comprehension how they do the job may help you make educated selections that could help you save plenty of strain and money In the end. So, Enable’s dive into what coverage answers are all about, why they make any difference, and how to select the finest a person for your needs.

At the guts of insurance policy options is the concept of security. Consider a safety Internet that catches you when lifetime throws you a curveball—irrespective of whether that’s a car or truck accident, a overall health crisis, or a home catastrophe. Coverage will work similarly. You fork out a quality, As well as in return, your insurance coverage provider claims to deal with selected money losses in the function of the catastrophe. These remedies can range between essential protection to more specialised options, dependant upon Everything you're trying to shield.

When you consider insurance policies, you might imagine wellness ideas or automobile insurance coverage, but there’s an entire universe of selections around. Property insurance policy, existence insurance plan, incapacity insurance coverage, and even more—each is a novel Resolution tailored to handle distinct risks. For illustration, everyday living insurance policy is a good selection for guaranteeing your family’s economic stability in the party of your passing. Conversely, residence insurance policy allows safeguard your assets and possessions from injury owing to fire, theft, or natural disasters.

Some Known Details About Flexible Insurance Solutions

Choosing the suitable insurance policies Option is dependent intensely on your own instances. Have you been a younger Qualified just getting started? Or maybe there is a family and a mortgage loan to worry about? These components Enjoy An important purpose in deciding which kind of protection you need. For anyone who is one and don't individual a home, a essential well being insurance plan prepare might be enough for now. But In case you have dependents, you might will need additional extensive lifestyle and wellness protection to protect Your loved ones's foreseeable future.

Choosing the suitable insurance policies Option is dependent intensely on your own instances. Have you been a younger Qualified just getting started? Or maybe there is a family and a mortgage loan to worry about? These components Enjoy An important purpose in deciding which kind of protection you need. For anyone who is one and don't individual a home, a essential well being insurance plan prepare might be enough for now. But In case you have dependents, you might will need additional extensive lifestyle and wellness protection to protect Your loved ones's foreseeable future.It is easy to receive overcome with each of the jargon and various plan alternatives in existence. But don’t Enable that scare you absent. Visualize insurance policy like a Software to control risk and safeguard your long term. The main element is being familiar with what threats you are exposed to and what you want to shield. Such as, in case you travel routinely, car insurance plan is often a no-brainer. In case you personal beneficial residence, property insurance policies can help you save from the economical fallout of disasters.

A single vital factor to look at when analyzing insurance policies alternatives is your spending plan. Unique procedures have distinct cost tags, and It is essential to discover a harmony among adequate coverage and affordability. You don’t have to interrupt the financial institution to protected very good security, but You furthermore may don’t want to skimp on protection just to save a couple of dollars. Think about insurance coverage as an investment decision inside your satisfaction—it’s about ensuring that you are not economically exposed when daily life throws an unanticipated challenge your way.

A different part to bear in mind is the insurer’s popularity and reliability. It’s not adequate to simply decide any insurance provider. You have to do your research and locate a service provider that’s reputable and noted for great customer care. After all, what’s the point of getting insurance policy if the corporate won’t spend out if you require them most? Search for insurers that have powerful evaluations as well as a history of providing reputable, prompt promises dealing with.

Customization is A significant benefit On the subject of modern-day insurance plan remedies. Numerous insurers help you tailor your policy to fit your precise wants. This can involve changing coverage boundaries, incorporating riders, or bundling different types of insurance policy (like house and car) for more financial savings. Should you have precise requires, like insuring a uncommon collection or offering for the Distinctive-needs dependent, you are able to normally locate a policy that matches All those requires specifically.

Online Insurance Solutions for Dummies

A lesser-recognized aspect of insurance policy answers is definitely the role of deductibles. This is actually the amount of money you have to spend out-of-pocket just before your insurance policies kicks in. A higher deductible ordinarily lowers your high quality, but Furthermore, it usually means you'll be within the hook For additional of the costs if a little something goes Completely wrong. It's a trade-off between preserving dollars upfront and being well prepared for prospective expenditures down the road. Weighing your choices meticulously can make sure your deductible is in Find more step with your economic problem and risk tolerance.It’s also crucial to think about the prolonged-term when choosing coverage answers. Everyday living variations—Professions evolve, households expand, properties get obtained, and wellness wants change. Your insurance needs will probably change with it. That’s why it’s imperative that you assessment your policies periodically and make adjustments as desired. For instance, should you’ve not long ago had a child, it is advisable to update your life coverage plan to mirror The brand new relative. Or, when you’ve paid out off your vehicle bank loan, you might want to reassess your automobile insurance coverage.

When you’re a company operator, the whole world of coverage will get all the more intricate. Business insurance policy answers are designed to safeguard your organization from a number of dangers, which include house harm, liability, employee accidents, and a lot more. Visualize it as a shield that retains your online business Risk-free from surprising financial setbacks. From tiny corporations to massive enterprises, acquiring the best insurance coverage can necessarily mean the distinction between holding your doorways open or facing economic ruin.

As well as personalized and business insurance policy, Additionally, there are specialised remedies like pet insurance plan, journey insurance coverage, and incapacity insurance policy. Pet coverage can assist you address veterinary charges in the event of sickness or personal injury, although vacation insurance policy can offer coverage for trip cancellations, shed luggage, and clinical emergencies although abroad. Incapacity insurance coverage is a vital solution should you rely upon your capacity to function and want to protect your revenue in the event of a mishap or illness that leaves you struggling to generate a dwelling.

The whole process of implementing for insurance answers is now a lot easier through the years. Several insurance coverage businesses now offer on the web equipment that let you Evaluate quotes, personalize guidelines, and even invest in coverage in just a few clicks. This usefulness saves time and would make the process a great deal more accessible to the standard client. However, it’s still imperative that you read through the fantastic print and have an understanding of what your plan handles, and that means you’re not caught off guard after you require it most.

When it comes to claims, insurance corporations commonly have a process that assists guarantee every little thing is handled efficiently. Nevertheless, this could vary according to the insurance provider. Some firms are noted for their rapidly and effective promises procedures, while others might have a far more sophisticated or time-consuming program. In case you’re worried about how your claims might be taken care of, it’s truly worth examining reviews or asking for recommendations from present or earlier customers.

In some instances, insurance coverage methods can be made use of as a Instrument for saving. Particular policies, like life coverage that has a hard cash value ingredient, can accumulate a funds value eventually. Therefore In combination with offering a Dying advantage, your coverage could also act as a type of financial savings or investment. If This really is something which pursuits you, it’s crucial that you understand how the money price will work and whether or not it aligns with the extended-time period financial objectives.

An additional thing to consider when Discovering insurance policies methods may be the affect of deductibles and rates on your own day-to-working day finances. A reduced quality may well appear to be appealing, nonetheless it could come with a greater deductible, which might not be ideal if you want rapid aid. It is necessary to calculate what you can afford to pay for within the party of the emergency, together with what fits comfortably into your every month finances. Insurance is just not intended to get a economical stress but fairly a lifeline whenever you want it most.

Insurance answers also play a important job in serving to businesses mitigate danger. By way of example, in case you run a corporation that offers with the general public, liability coverage can shield you from lawsuits connected to injuries or accidents that transpire in your premises. In the same way, residence Find more info insurance will let you Recuperate if your organization suffers injury due to a fire, flood, or other unanticipated situations. By having the right insurance coverage coverage set up, you make a security net that lets you give attention to escalating your online business rather than stressing in regards to the "what-ifs."

What Does Long-Term Insurance Solutions Mean?

Eventually, insurance policies alternatives are about comfort. They are not pretty much steering clear of financial decline—they’re about sensation self-assured and safe while in the facial area of daily life’s uncertainties. No matter if you happen to be buying a new home, Visit website setting up a family members, or creating a enterprise, insurance plan assists make certain that you're not remaining uncovered when items go wrong. By Discovering your options and obtaining the best insurance policies Resolution for your personal exceptional needs, you’ll be able to confront the long run with assurance, knowing you’ve obtained the correct security in place.

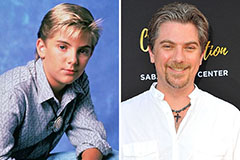

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now!